Some Known Incorrect Statements About Bankruptcy Lawyer Tulsa

The smart Trick of Top Tulsa Bankruptcy Lawyers That Nobody is Talking About

Table of ContentsThe Basic Principles Of Chapter 13 Bankruptcy Lawyer Tulsa Chapter 7 - Bankruptcy Basics Things To Know Before You Get This10 Simple Techniques For Chapter 13 Bankruptcy Lawyer TulsaThe Only Guide to Tulsa Ok Bankruptcy AttorneyNot known Facts About Top Tulsa Bankruptcy Lawyers

The stats for the various other primary type, Chapter 13, are even worse for pro se filers. (We damage down the differences between the two enters depth listed below.) Suffice it to state, consult with an attorney or more near you that's experienced with bankruptcy regulation. Here are a couple of resources to discover them: It's understandable that you may be hesitant to spend for an attorney when you're already under considerable financial stress.Numerous lawyers also use totally free assessments or email Q&A s. Take advantage of that. Ask them if insolvency is certainly the ideal choice for your situation and whether they believe you'll qualify.

Ad Currently that you've chosen personal bankruptcy is undoubtedly the right training course of activity and you hopefully cleared it with an attorney you'll require to obtain started on the documents. Before you dive right into all the main bankruptcy kinds, you must obtain your own documents in order.

Getting The Chapter 7 Bankruptcy Attorney Tulsa To Work

Later on down the line, you'll actually need to confirm that by revealing all sorts of info concerning your monetary affairs. Below's a standard list of what you'll require on the roadway ahead: Determining documents like your chauffeur's license and Social Protection card Tax obligation returns (as much as the previous 4 years) Evidence of income (pay stubs, W-2s, self-employed earnings, revenue from possessions as well as any type of revenue from federal government benefits) Bank declarations and/or pension statements Evidence of worth of your possessions, such as car and property valuation.

You'll desire to recognize what type of financial debt you're trying to settle.

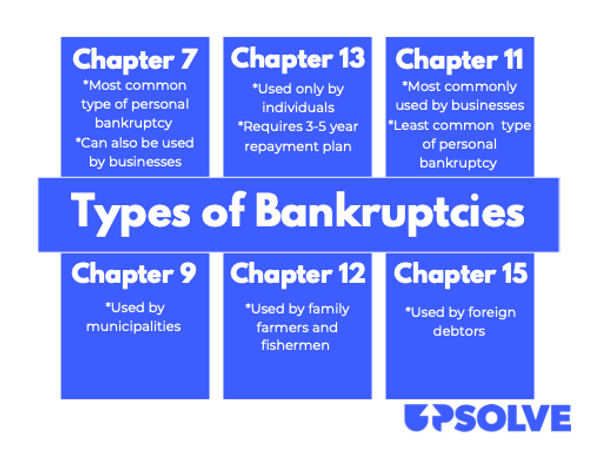

You'll desire to recognize what type of financial debt you're trying to settle.If your income is as well high, you have another alternative: Chapter 13. This option takes longer to settle your financial obligations due to the fact that it calls for a long-term payment plan usually 3 to five years prior to a few of your remaining debts are cleaned away. The filing process is also a great deal extra complex than Phase 7.

9 Easy Facts About Affordable Bankruptcy Lawyer Tulsa Explained

A Phase 7 insolvency remains on your debt record for ten years, whereas a Chapter 13 personal bankruptcy drops off after seven. Both have lasting effect on your credit history, and any type of brand-new financial obligation you get will likely come with higher rates of interest. Prior to you send your bankruptcy kinds, you have to first finish a necessary program from a credit counseling company that has been accepted by the Department of Justice (with the remarkable exemption of filers in Alabama or North Carolina).

The course can be finished online, personally or over the phone. Training courses usually cost between $15 and $50. You should finish the course within 180 days of filing for personal bankruptcy (bankruptcy attorney Tulsa). Make use of the Department of Justice's site to discover a program. If you reside in Alabama or North Carolina, you must select and finish a training course from a listing of independently authorized companies in your state.

Top-rated Bankruptcy Attorney Tulsa Ok Fundamentals Explained

An attorney bankruptcy attorney Tulsa will usually handle this for you. If you're submitting by yourself, recognize that there have to do with 90 various personal bankruptcy districts. Check that you're submitting with the correct one based upon where you live. If your irreversible house has actually relocated within 180 days of loading, you need to submit in the area where you lived the greater section of that 180-day duration.

Usually, your bankruptcy attorney will work with the trustee, yet you may require to send out the person documents such as pay stubs, tax obligation returns, and financial institution account and credit score card statements straight. A common misunderstanding with personal bankruptcy is that when you submit, you can quit paying your financial obligations. While read the full info here personal bankruptcy can help you wipe out several of your unsafe financial obligations, such as past due medical expenses or personal car loans, you'll want to keep paying your month-to-month payments for protected financial debts if you desire to maintain the home.

Tulsa Bankruptcy Filing Assistance - Truths

If you go to risk of repossession and have actually worn down all other financial-relief options, then submitting for Chapter 13 might delay the foreclosure and conserve your home. Ultimately, you will certainly still require the earnings to proceed making future home loan settlements, as well as repaying any kind of late payments throughout your payment strategy.

If so, you might be needed to provide additional information. The audit could delay any type of financial debt relief by a number of weeks. Of program, if the audit shows up incorrect info, your instance can be rejected. All that said, these are fairly rare instances. That you made it this much in the process is a good indicator a minimum of a few of your debts are eligible for discharge.